-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

No Comments

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.

-

The Nine GATS Strategies: A Quantum-Inspired Trading Spectrum

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Algorithmic Trading, Quantum-Inspired Trading Systems

Financial markets, like quantum systems, are probabilistic and dynamic, oscillating between bullish, bearish, and choppy states. Dr. Glen Brown’s Nine-Laws Framework, powered by the Global Algorithmic Trading Software (GATS), harnesses this complexity through nine strategies, from the rapid Global Momentum Scalper (GATS1) to the enduring Global Monthly Trend Rider (GATS9). This article introduces these strategies, spanning timeframes from 1-minute to monthly, and their quantum-inspired design, rooted in the √Time Principle (√256 ≈ 16 exposures). By blending financial engineering with concepts like entanglement and path-dependent memory, GATS strategies offer a rigorous approach to trend-following and risk management, setting the stage for a series exploring the Nine Laws.

-

Dr. Glen Brown’s Nine-Laws Framework Adaptive Volatility & Risk Management for Global Markets

- June 16, 2025

- Posted by: DrGlenBrown2

- Categories: Algorithmic Trading, ATR Trailing Stops, Model Validation “Law Rebirth”, Portfolio Construction, Risk Management, Volatility Modeling

Explore Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management: an in-depth guide to regime detection, adaptive stops, break-even logic, portfolio noise budgeting & continuous model rebirth.”

-

Dr. Glen Brown’s Nine‑Laws Framework for Adaptive Volatility and Risk Management

- June 12, 2025

- Posted by: DrGlenBrown2

- Category: Quantitative Finance / Risk Management

Discover a nine‑law adaptive risk framework and a 0.01 %–9 % equity risk grid for modern FX trading.

-

Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management

- June 9, 2025

- Posted by: DrGlenBrown2

- Category: Quantitative Finance / Risk Management

Discover how Dr. Glen Brown’s Nine-Laws Framework transforms FX risk management with adaptive volatility signals, regime detection, and multi-layered stop rules to stay ahead of market shifts.

-

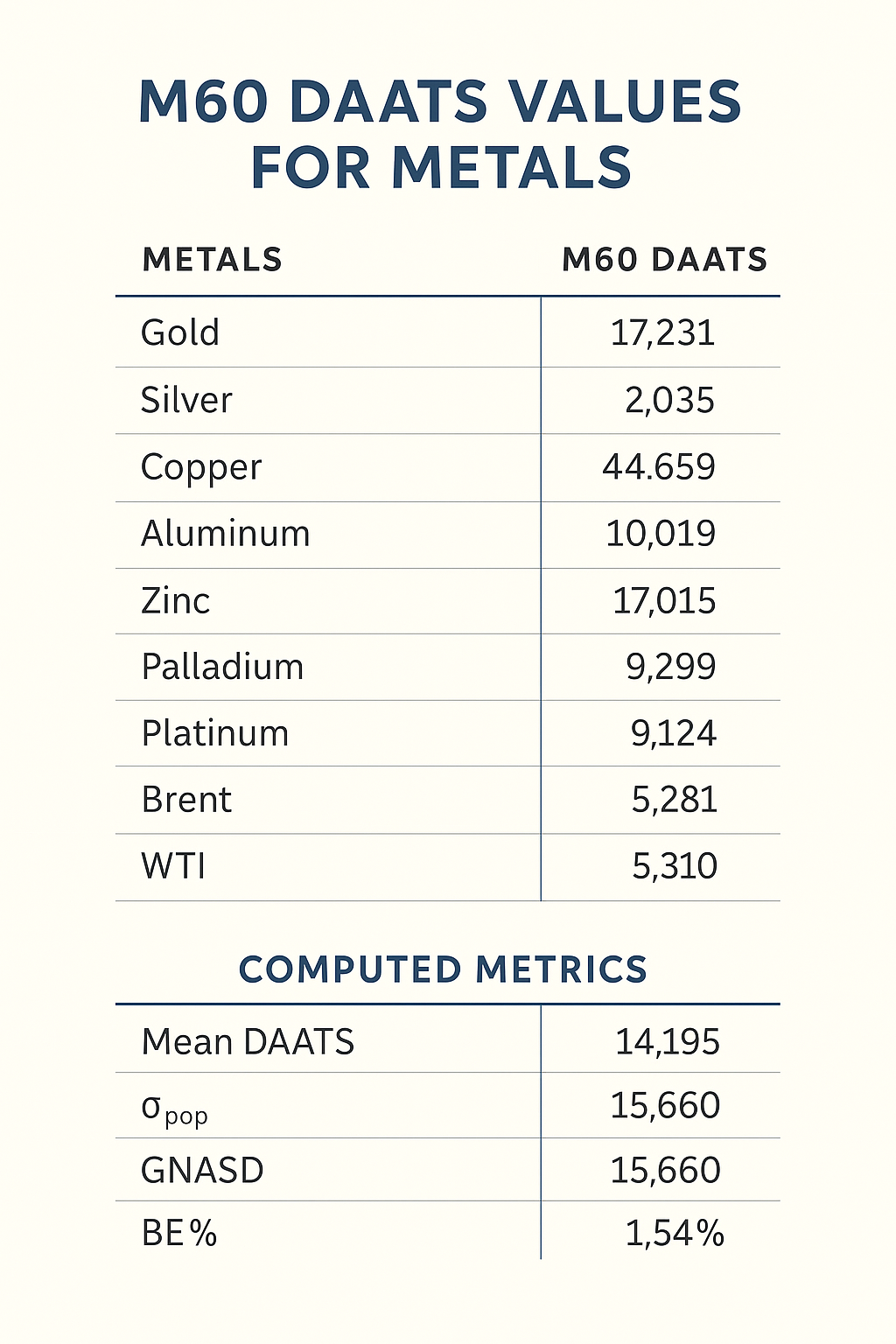

Calculating GNASD & BE% for an M60 Metals Portfolio

- June 2, 2025

- Posted by: DrGlenBrown2

- Category: GATS Methodology

Learn how to compute portfolio σpop, GNASD (one-sigma noise unit), and BE% for 10 metals (Gold, Silver, Copper, Aluminum, Zinc, Lead, Palladium, Platinum, Brent, WTI) using updated M60 DAATS values.

-

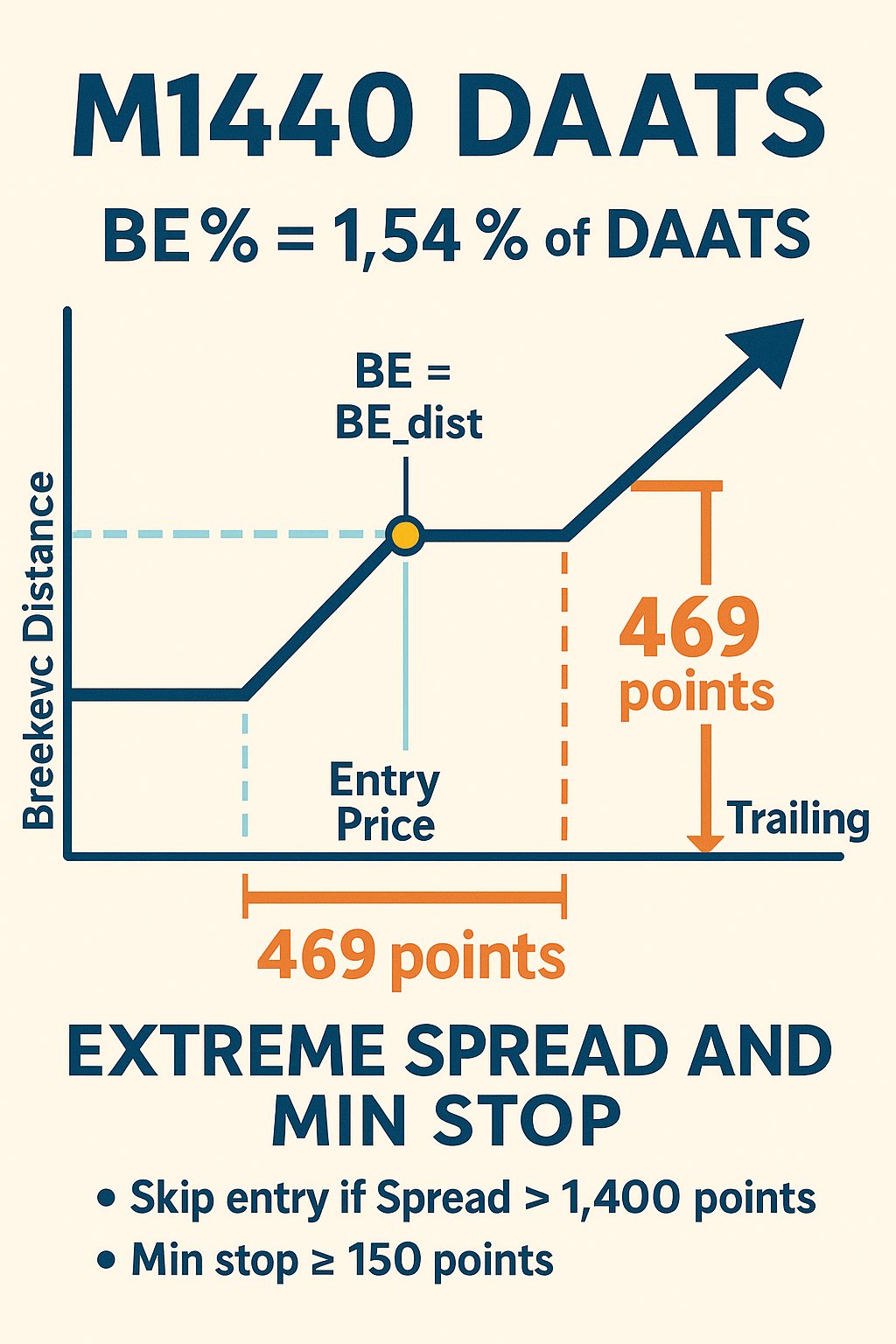

Final M1440 DAATS Lecture: Breakeven & Trailing Stops with Extreme Spread Handling

- June 1, 2025

- Posted by: DrGlenBrown2

- Category: GATS Methodology

Learn our final M1440 DAATS framework for 28 forex pairs: BE % = 1.54 % of DAATS, post‐BE trailing = 469 points, and skip entries if spread > 1 400 points, all aligned with Dr. Brown’s Seven Laws.

-

Recalculating BE% & GNASD for GEMF – USA Sub‐Fund (June 1, 2025)

- June 1, 2025

- Posted by: DrGlenBrown2

- Category: Blog

Learn how to recalculate portfolio BE% and GNASD (one-sigma noise unit) for GEMF – USA Sub-Fund using updated M60 DAATS values on June 1, 2025. Includes formulae, examples, and implementation linked to Dr. Brown’s Seven Laws.

-

Applying M60 DAATS & GNASD Logic to Equities: GEMF – USA Sub‐Fund

- May 31, 2025

- Posted by: DrGlenBrown2

- Category: GATS Methodology

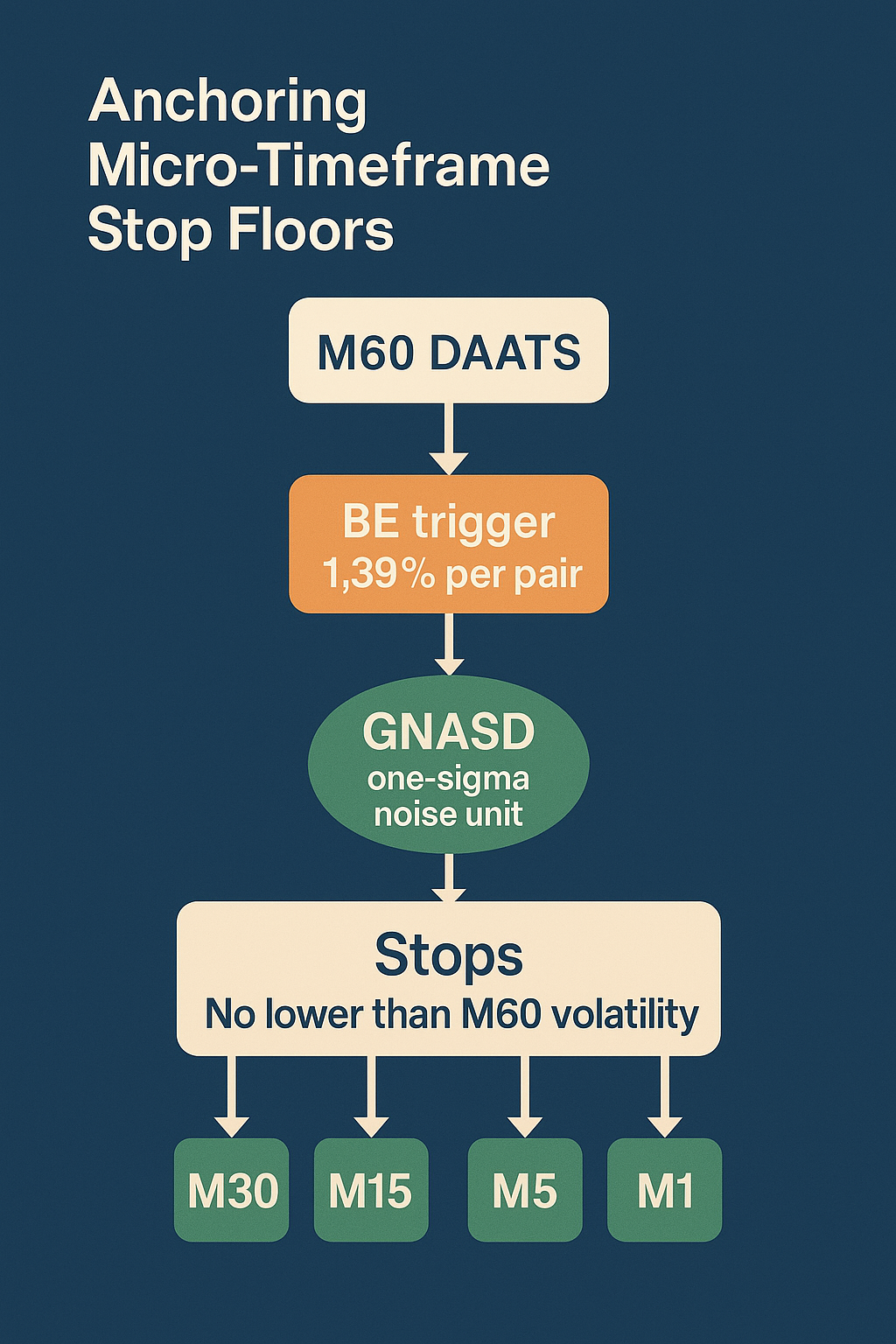

Learn how GEMF – USA Sub-Fund uses M60 DAATS and GNASD to set stop floors, breakeven triggers, and trailing stops on micro-timeframes (M30, M15, M5, M1) under the Daily MACD bias and M60 EMA regime.

-

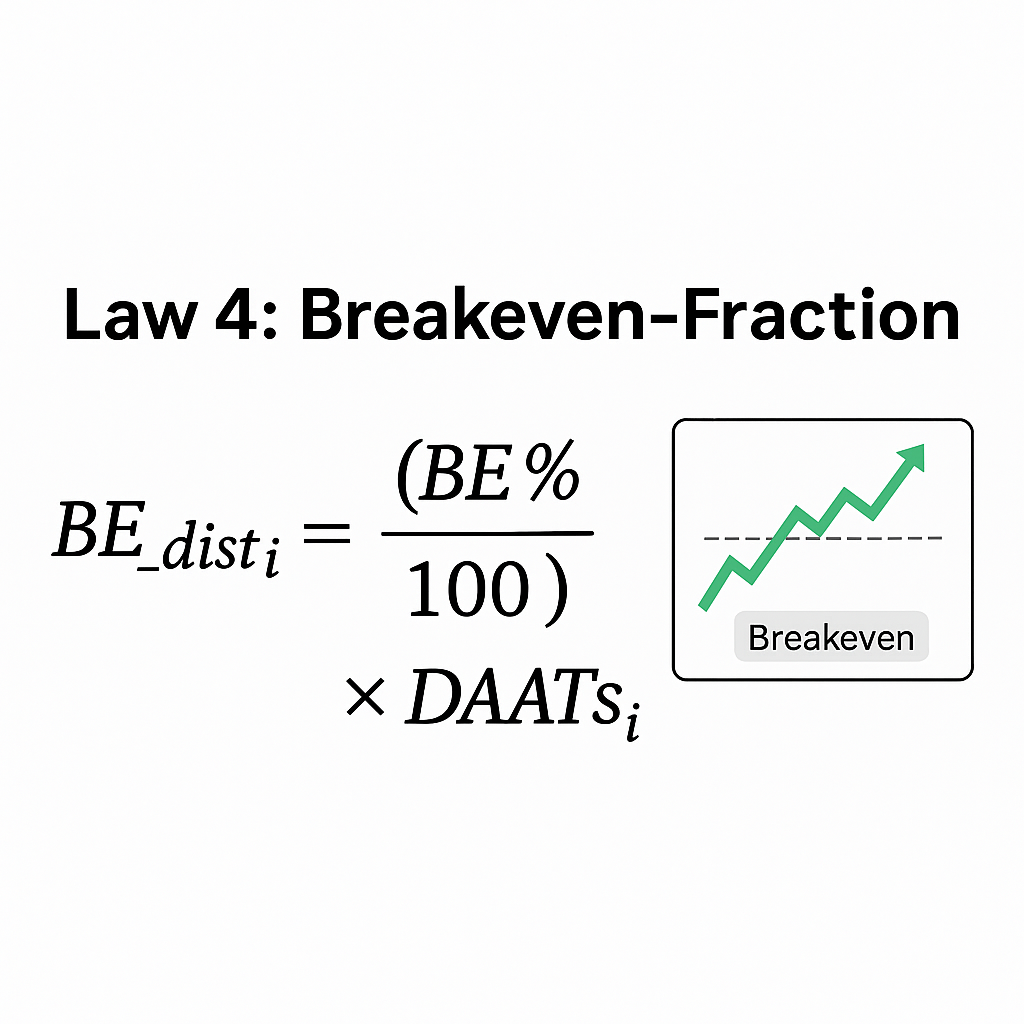

Micro‐Timeframe Stop Floors & Breakeven Logic Using M60 DAATS & GNASD

- May 31, 2025

- Posted by: DrGlenBrown2

- Category: GATS Methodology

In this lecture, we demonstrate how GATS leverages M60 DAATS and the portfolio’s one‐sigma noise unit (GNASD) to establish robust stop‐loss floors, breakeven triggers, and trailing stops on M30, M15, M5, and M1. By anchoring micro‐timeframe stops to hourly volatility and applying a 1.39% breakeven rule per pair, traders can avoid routine hourly whipsaw while still capturing high‐probability moves under the Daily MACD bias and M60 EMA regime filters.