-

DGB-FX v1.2 — PPP, REER & IRP Valuation for Major FX

- August 13, 2025

- Posted by: DrGlenBrown2

- Category: Blog

No CommentsDGB-FX v1.2 by Dr. Glen Brown: a multi-anchor FX valuation model blending PPP, REER deviation, and 1-year IRP with regime weighting and a margin of safety. Includes charts, methodology, and pair-by-pair commentary.

-

The Dr. Glen Brown Forex Valuation Model (DGB-FVM): A Unified Macro-Tactical Framework for Currency Fair Value

- August 12, 2025

- Posted by: DrGlenBrown2

- Category: Global Research & Models

Introducing DGB-FVM—the missing valuation anchor for FX. A unified macro-tactical framework with PPP/REER/IRP, risk premia, GATS integration, and a EURUSD example.

-

DGB-FX v1.0 — A Risk-Aware, Regime-Weighted FX Valuation Model

- August 10, 2025

- Posted by: DrGlenBrown2

- Category: Quant Research

DGB-FX v1.0 adapts the Dr. Glen Brown equity method to FX with PPP/REER/IRP anchors, regime-weighted scenarios, MOS, and a consensus blend. Download the calculator and script.

-

Gold Strategy Update — August 8, 2025: Applying Dr. Glen Brown’s Nine Laws with GATS

- August 8, 2025

- Posted by: DrGlenBrown2

- Category: Global Daily Insights

A disciplined, bullish-only Gold plan for August 8, 2025—aligning GATS with Dr. Glen Brown’s Nine Laws to filter noise, trail with DAATS, and exit only on death points.

-

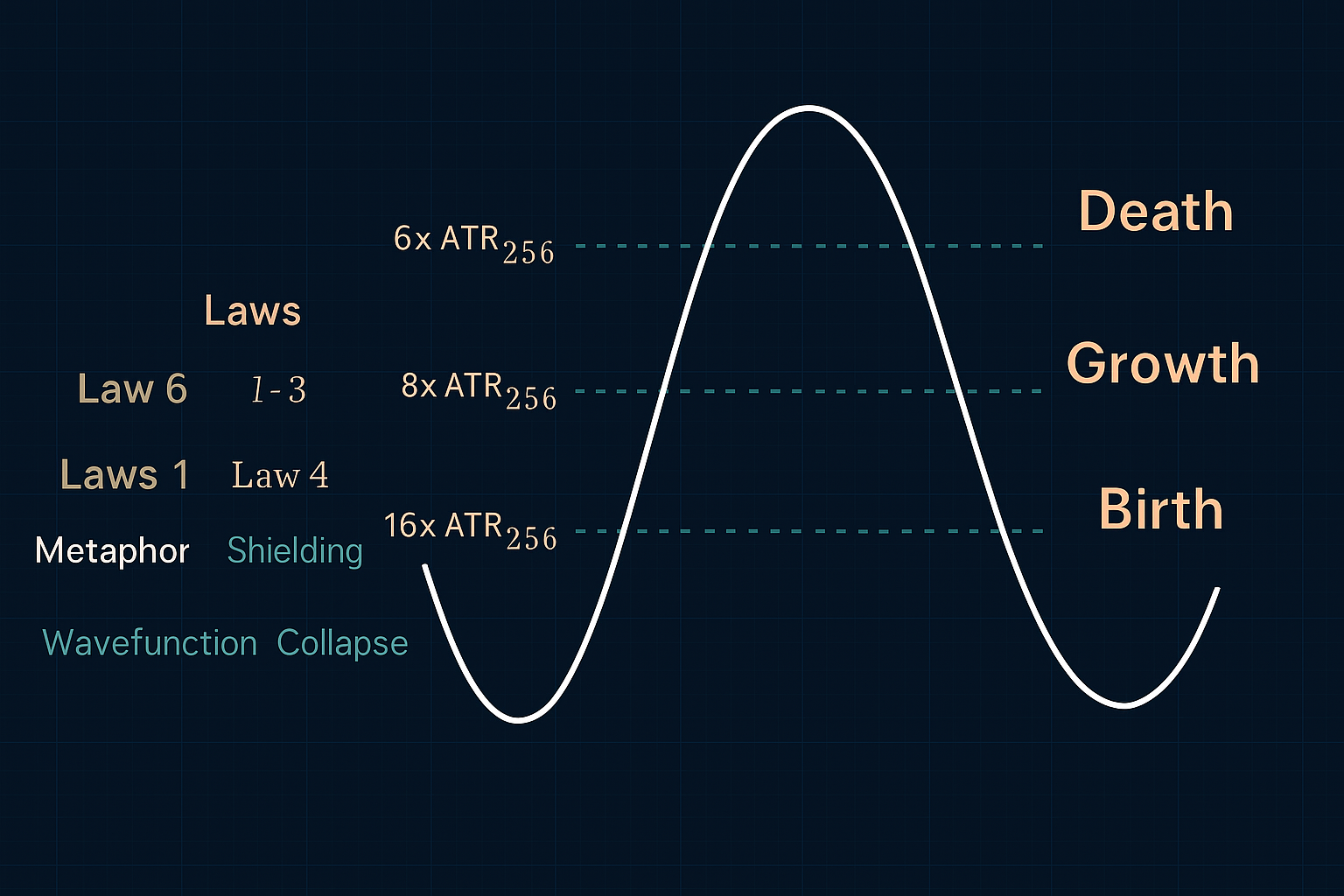

Quantum Risk Mastery: Dr. Glen Brown’s Nine Laws Framework for Adaptive Volatility Stop-Loss and Risk Management

- August 3, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering & Trading Strategies

Discover how Dr. Glen Brown fuses quantum mechanics narratives with nine principled laws to create an adaptive volatility stop-loss and risk management framework—reinventing portfolio protection in today’s markets.

-

Dr. Glen Brown’s Nine-Laws Framework: A Quantum Revolution in Volatility Risk Management

- July 31, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering

Discover how Dr. Glen Brown’s Nine-Laws Framework applies quantum mechanics concepts—superposition, density matrices, and Lindblad dynamics—to adaptively manage volatility and risk in forex, equities, commodities, and crypto strategies.

-

The Volatility Root Law – Part II: From Fractal Breakeven to Volatility-Defined Death

- July 20, 2025

- Posted by: DrGlenBrown2

- Category: Quantitative Trading, Risk Engineering

Part II of Dr. Glen Brown’s Volatility Root Law reveals a quantum volatility lifecycle framework that governs trade entry, breakeven, trailing stops, and exit using fractal amplitude theory and temporal anchoring—structured through the Nine Laws of Adaptive Risk.

-

Global Weekly Forex Portfolio Risk Management Guide For Global Traders

- July 3, 2025

- Posted by: DrGlenBrown2

- Category: Forex Portfolio Analysis, Quantum Risk Management

This weekly guide leverages Dr. Glen Brown’s quantum-inspired Nine-Laws Framework and GATS methodology to deliver adaptive, self-calibrating risk controls—stops, break-evens, and position sizing—across a global portfolio of 28 major FX pairs.

-

The Quantum Edge – Synthesizing the Nine Laws

- June 29, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Quantum-Inspired Trading Systems, Holistic Strategy Synthesis

Trading is a quantum dance of uncertainty and precision, mastered through a unified framework. Dr. Glen Brown’s Nine-Laws Framework synthesizes the nine GATS strategies with quantum principles, from entanglement to state tomography, to navigate markets across timeframes. This article unifies the series, showcasing how GATS1 to GATS43200 deliver a quantum edge from minutes to months, optimizing returns and risks.

-

Comparing GATS Strategies – A Quantum Spectrum of Performance

- June 29, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Strategy Evaluation, Quantum-Inspired Trading Systems

Trading strategies span a quantum spectrum, each measuring market states at different scales. Dr. Glen Brown’s Nine-Laws Framework powers the nine GATS strategies, from GATS1’s rapid scalping to GATS9’s long-term trends, offering a range of performance profiles. This article compares their effectiveness across timeframes, leveraging quantum multi-scale principles to optimize returns from minutes to months.