-

Common Misinterpretations and Misuse of the Forward Transition Shadow

- January 9, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

No Comments

This article clarifies common misinterpretations of the Forward Transition Shadow, protecting the integrity of the GATS structural doctrine.

-

How FTS Changes Risk Posture, Not Just Entries

- January 9, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

The Forward Transition Shadow regulates risk posture before entries, shifting exposure based on structural coherence rather than signals alone.

-

Forward Transition Shadow Across Timeframes

- January 6, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

The Forward Transition Shadow reveals structural stability and stress across timeframes, ensuring lower-timeframe decisions respect higher-timeframe regimes.

-

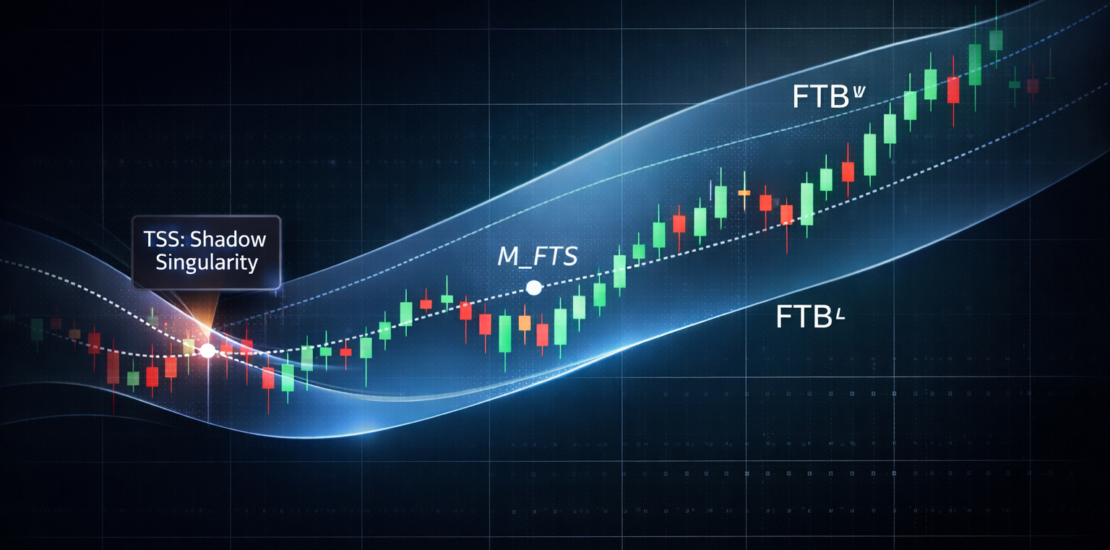

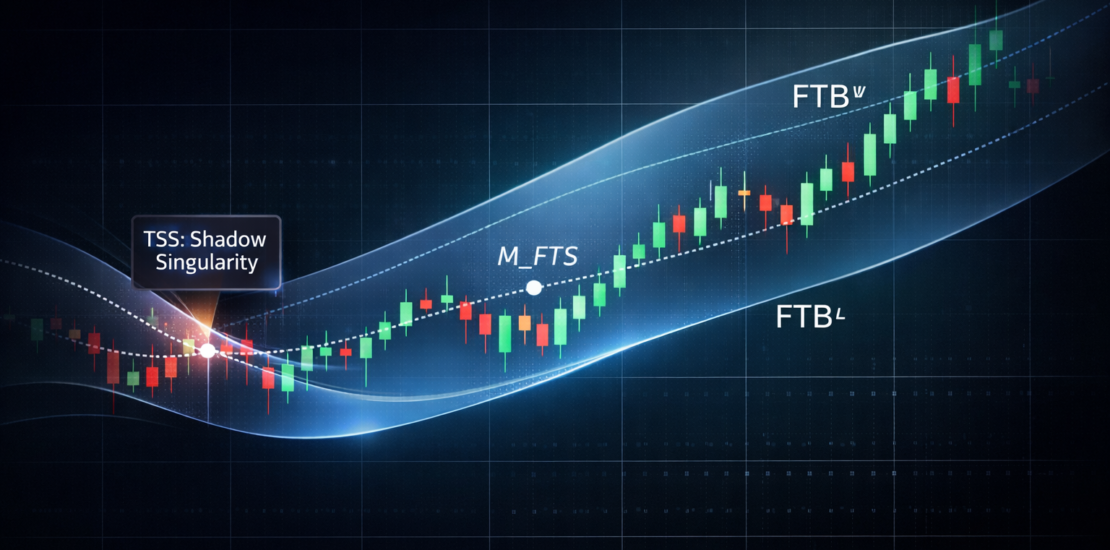

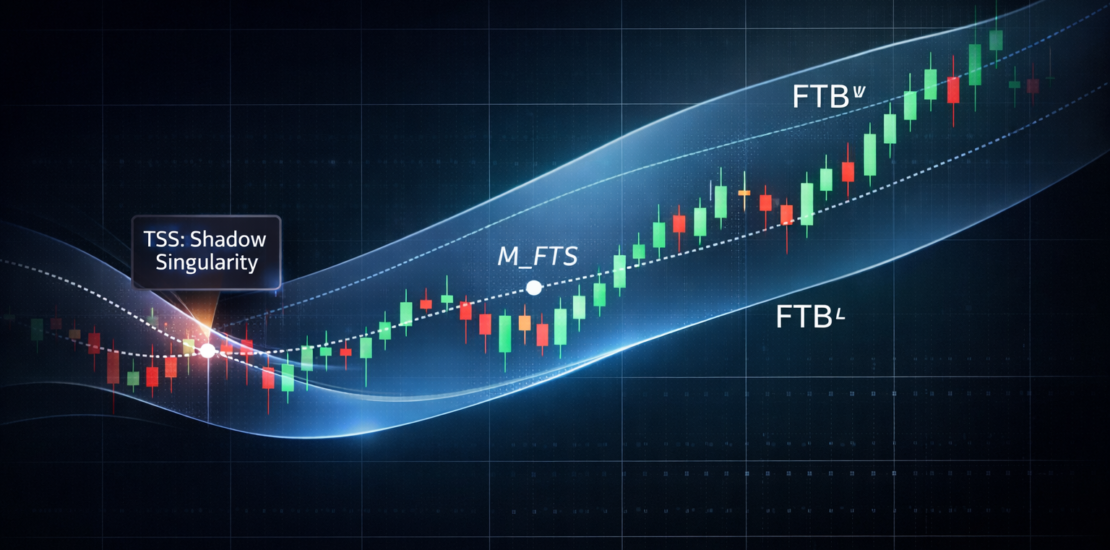

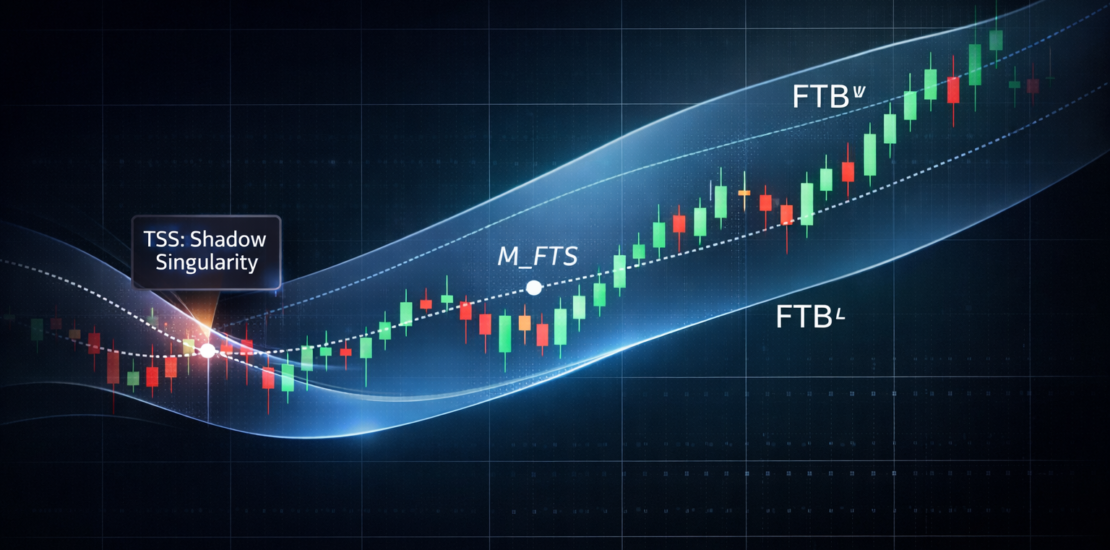

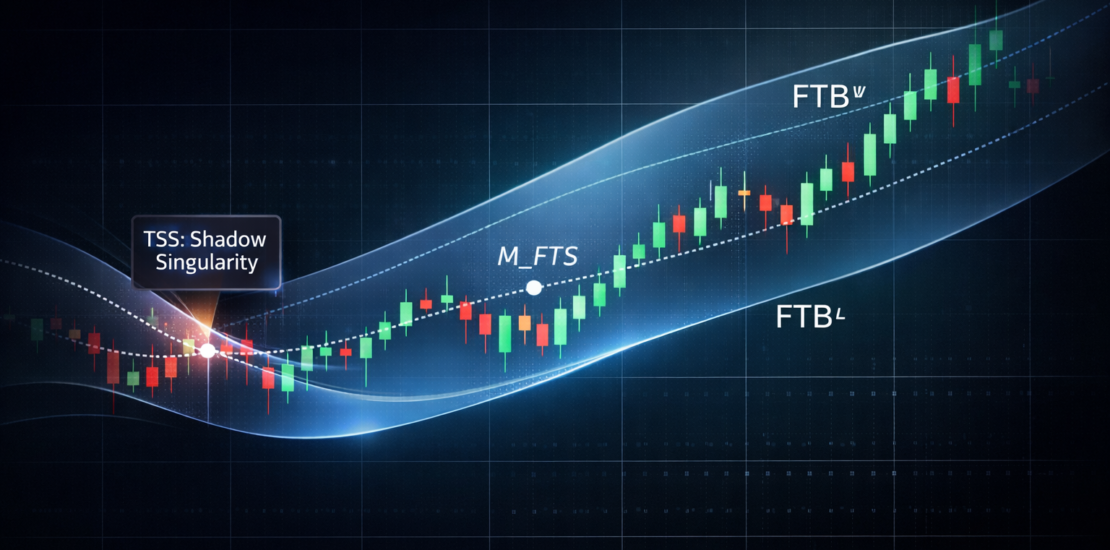

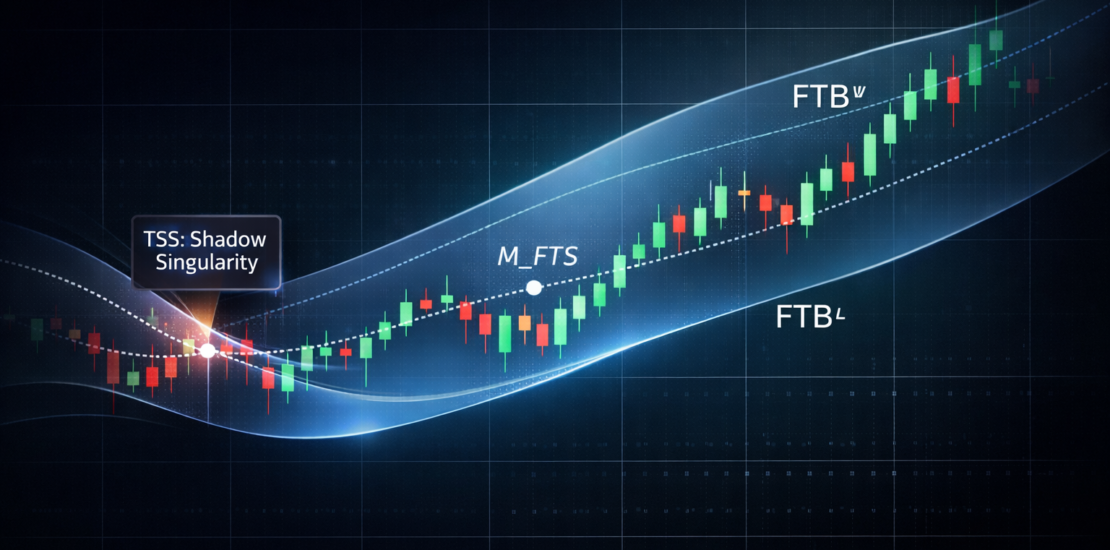

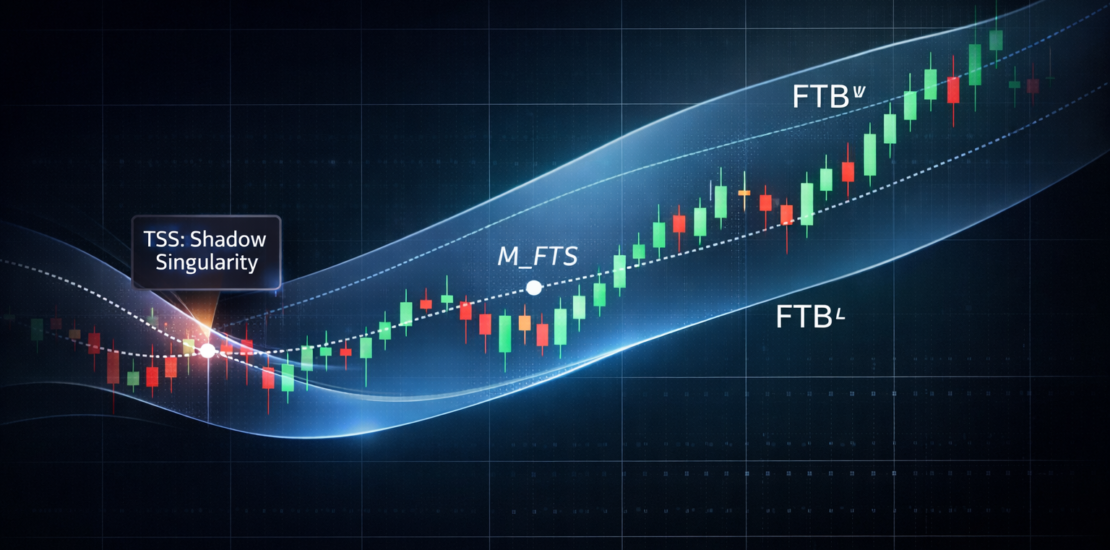

Transition Shadow Singularity (TSS): Regime Stand-Down and Structural Reset

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

The Transition Shadow Singularity marks a collapse of structural memory, enforcing a stand-down period until a new regime coherently forms.

-

Shadow Width, Compression, and Structural Stress

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Shadow width within the Forward Transition Shadow exposes structural stress and compression, providing early warning of regime instability before price reversals.

-

The Forward Transition Shadow as a Negotiation Corridor

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

The Forward Transition Shadow reframes the Transition Zone as a negotiation corridor, allowing traders to classify dominance, pullbacks, and structural failure with clarity.

-

Understanding FTBᵁ and FTBᴸ as Forward-Staged Structure

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

A new GATS structural doctrine that projects the Transition Zone forward into a “shadow band” to filter regimes, validate pullbacks, and enforce stand-down rules when structure collapses and inverts.