Transition Shadow Singularity (TSS): Regime Stand-Down and Structural Reset

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Forward Transition Shadow Series — Part 5

This article expands on the Forward Transition Boundary (FTBᵁ / FTBᴸ) and Forward Transition Shadow (FTS) doctrine within the GATS Framework. The complete and authoritative doctrine is published here: Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

1. Why the Crossing Matters

Most technical frameworks treat line crossings as signals. Within GATS, the crossing of the Forward Transition Boundaries is treated very differently.

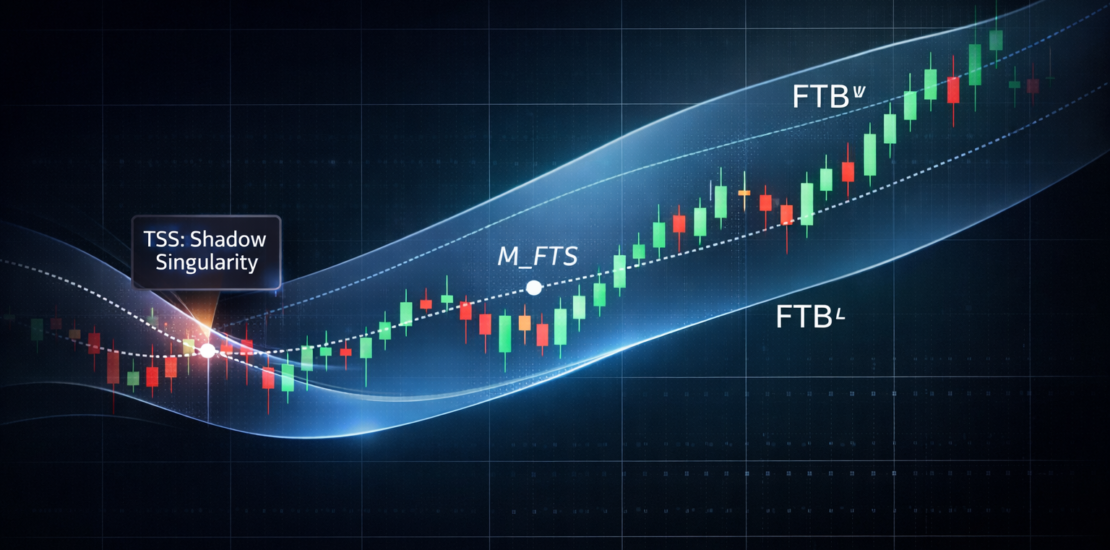

When FTBᵁ and FTBᴸ converge and cross, the Forward Transition Shadow collapses. This event is not a suggestion. It is a structural statement.

The Transition Shadow Singularity (TSS) marks the moment when forward-projected structural memory loses internal ordering.

2. What a Singularity Represents Structurally

In structural terms, a singularity is a point where a previously ordered system loses definable separation.

For the Forward Transition Shadow, this means:

- The remembered upper and lower Transition boundaries collapse into one another

- The width of the shadow approaches zero

- Structural agreement dissolves

The market is no longer evolving smoothly. It is reorganizing.

3. Why TSS Is Not a Trade Signal

Treating the TSS as an entry trigger is a category error.

Signals imply direction. Singularities imply uncertainty.

At TSS:

- Direction has not yet resolved

- Volatility may increase or compress further

- False moves are common

The correct interpretation is not “act”, but “stand down”.

4. The Regime Stand-Down Principle

Within GATS, the Transition Shadow Singularity enforces a non-negotiable operating rule:

When structural memory collapses, participation pauses.

This stand-down period exists to protect capital during the most ambiguous phase of regime transition.

The goal is not to predict the next regime, but to wait until structure re-forms coherently.

5. TSS as a Structural Reset

After a Transition Shadow Singularity, the market must rebuild structural agreement.

This rebuilding process typically involves:

- Expansion of shadow width from near zero

- Re-establishment of boundary ordering

- Clear price behavior relative to the reconstructed shadow

Only after this reset should directional participation resume, and only in alignment with higher-timeframe structure.

6. TSS vs Classical EMA Crossovers

Classical EMA crossovers often occur after structural damage has already taken place.

The Transition Shadow Singularity frequently appears earlier, during the compression phase when most systems remain active.

This timing difference explains why TSS is so effective as a capital-preservation mechanism.

7. Multi-Timeframe Context Is Mandatory

A TSS on a lower timeframe does not override higher-timeframe regime commitment.

Instead, it signals:

- Pause participation on the affected timeframe

- Defer directional bias to the higher timeframe

- Await structural re-alignment before re-engaging

This preserves coherence across the GATS multi-timeframe hierarchy.

8. Relationship to the Master Doctrine

This article explains the meaning and role of the Transition Shadow Singularity as a regime stand-down event.

All formal definitions, thresholds, and enforcement rules remain exclusively defined in the master doctrine:

Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

Next in the series:

Forward Transition Shadow Series — Part 6: Forward Transition Shadow Across Timeframes

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., proprietary trading firms specializing in institutional trading systems, volatility-aware risk management, and multi-timeframe market structure design through the GATS Framework.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as proprietary trading firms. All concepts discussed are provided for educational and informational purposes only and do not constitute investment advice or an offer to manage external capital.

General Disclaimer

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Trading decisions are the sole responsibility of the reader. Examples are illustrative and not indicative of future performance.

Risk Disclaimer

Trading financial markets involves substantial risk and may result in the loss of some or all invested capital. Past performance is not indicative of future results. Always assess your risk tolerance and seek independent professional advice where appropriate.