-

WTI Crude Oil “Multi-Frame Confluence Blueprint”

- May 19, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

No Comments

Discover the WTI Crude Oil “Multi-Frame Confluence Blueprint”—a step-by-step guide combining daily, 4H, and 1H EMA zones, MACD, oscillators & tactical trade plans.

-

NVIDIA (NVDA) Daily “Precision Breakout Blueprint”

- May 19, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

Discover the NVIDIA Daily “Precision Breakout Blueprint” with the GATS framework—EMA zones, MACD, oscillators & tactical trade plan for NVDA.

-

S&P 500 Daily “Broad Bull Momentum Blueprint”

- May 19, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

Explore the S&P 500 Daily “Broad Bull Momentum Blueprint” using our proprietary GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Gold Daily “Resilient Bull Under Pressure Blueprint”

- May 19, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

Discover the Gold Daily “Resilient Bull Under Pressure Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade planning.

-

Global Heiken-Ashi Smoothed (HAS): Candles that Clarify Trends

- May 6, 2025

- Posted by: DrGlenBrown2

- Category: Technical Analysis / Algorithmic Trading

Explore the HAS algorithm, its smoothing logic vs. standard Heiken-Ashi, trend-color rules, and how it synergizes with color-coded EMA zones for clearer trading signals.

-

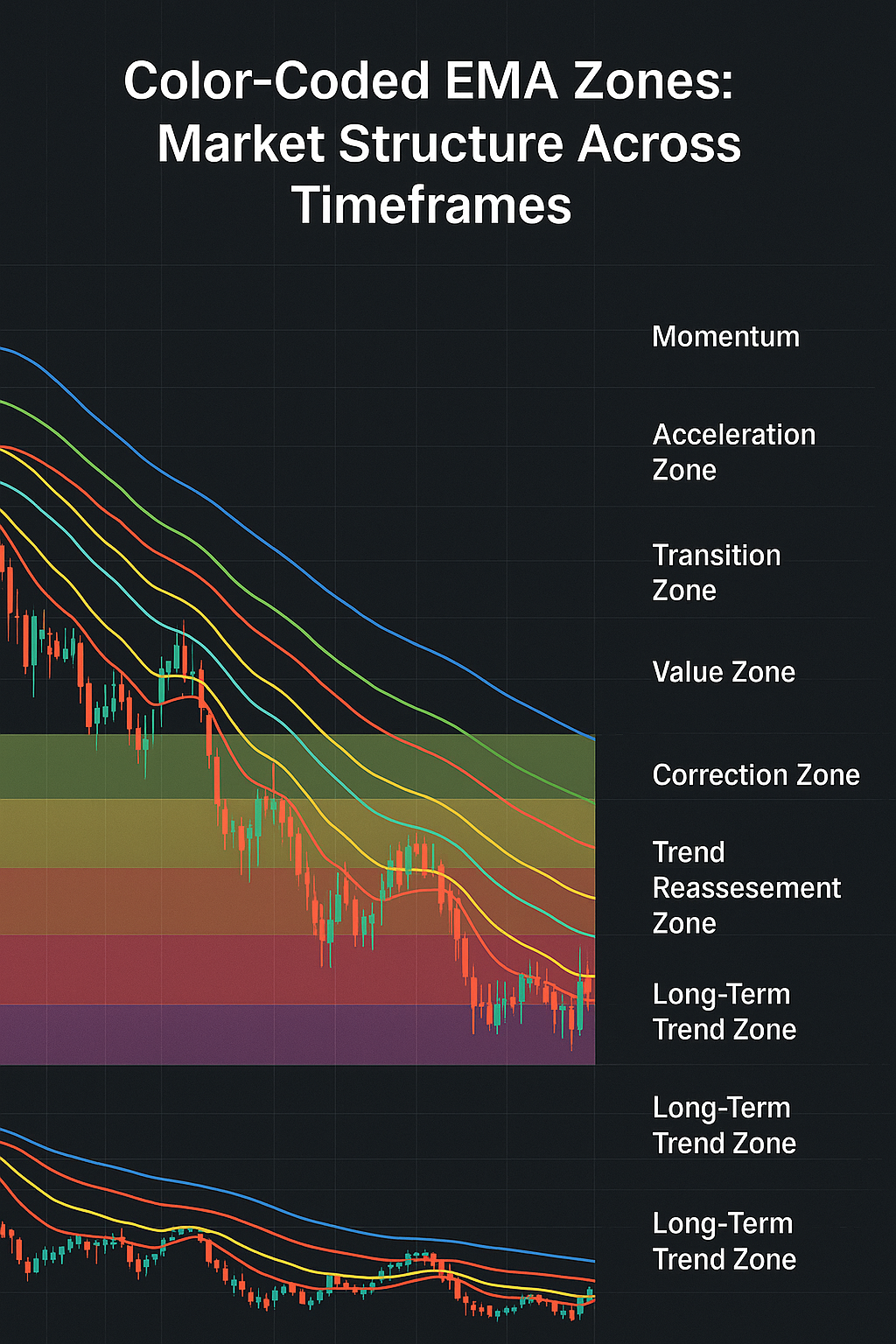

Color-Coded EMA Zones: Market Structure Across Timeframes

- May 6, 2025

- Posted by: DrGlenBrown2

- Category: Technical Analysis / Algorithmic Trading

Explore GATS’s seven EMA zones—from momentum to long-term trend—color mapping, Fibonacci derivation, and actionable entry/exit cues grounded in market structure.

-

GATS Unveiled: Philosophy, Architecture & Core Principles

- May 6, 2025

- Posted by: DrGlenBrown2

- Category: Algorithmic Trading / Financial Engineering

Explore the vision behind GATS: a transparent, adaptive, and modular algorithmic trading framework designed to harmonize indicators, risk controls, execution, and monitoring.

-

GATS Unveiled: The Heartbeat of Global Financial Engineering

- April 25, 2025

- Posted by: DrGlenBrown2

- Category: Proprietary Trading / Algorithmic Trading

Discover how GFE’s home-grown GATS platform transforms market data into actionable strategies through its modular design, advanced risk tools, and nine timeframe-specific approaches.

-

Adaptive Volatility Scaling in Financial Engineering: Integrating Technical Market Phases with the GATS Framework

- April 10, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering

Discover how the Adaptive Volatility Scaling Principle transforms risk management by integrating technical market phases with the GATS Framework. Learn how our innovative approach enhances dynamic trailing stops and break-even triggers for superior systematic trading performance.

-

Intellectual Commentary: GBP/USD Analysis Using GATS Methodology

- November 16, 2024

- Posted by: DrGlenBrown2

- Categories: Forex Analysis, Forex Market Analysis, Forex Trading Education

A comprehensive GBP/USD analysis leveraging the GATS methodology, including market structure insights, GATS 369 Channel dynamics, and trading setups.