-

The Quantum Narrative of EMA Zones and MACD(15,25,8) – Part II

- August 31, 2025

- Posted by: DrGlenBrown2

- Category: Quantum Trading Philosophy

No Comments

Explore Bitcoin and EURUSD case studies, fractal uncertainty geometry, and the metaphysical laws of trading. A sacred quantum philosophy emerges, uniting financial engineering with the Nine Laws.

-

The Quantum Narrative of EMA Zones and MACD(15,25,8)

- August 31, 2025

- Posted by: DrGlenBrown2

- Category: Quantum Trading Philosophy

A deep exploration of EMA Zones, MACD, and the Nine Laws reimagined as quantum mechanics operators and wavefunctions. A transformative trading philosophy.

-

Indicator Integration Framework – M1440 Anchor

- August 31, 2025

- Posted by: DrGlenBrown2

- Category: Global Trading Playbooks

Discover how indicators integrate with EMA Zones in the GATS ecosystem. From RSI to MACD and Fractals, learn the full workflow for trend following anchored on M1440.

-

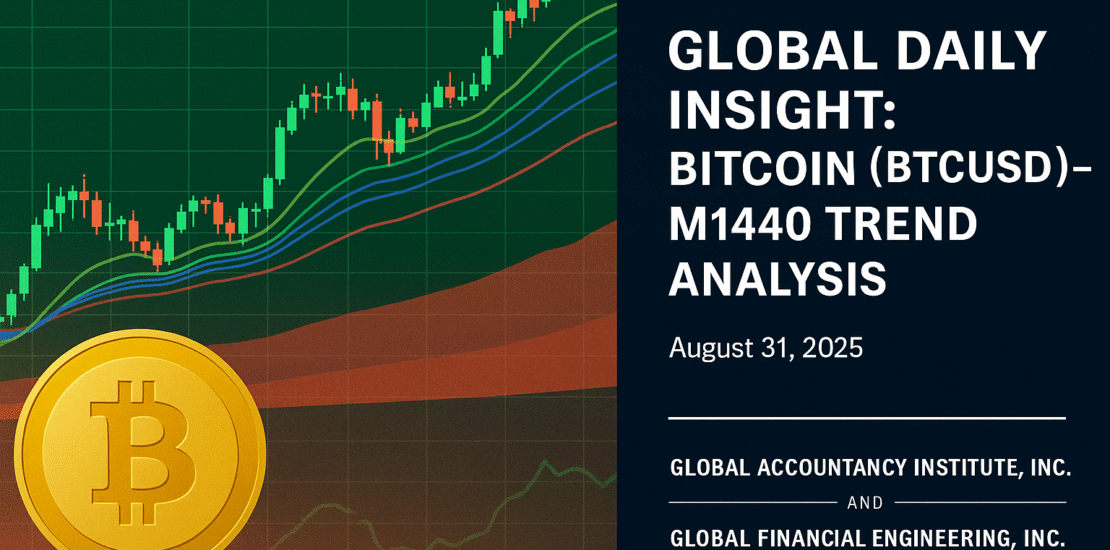

Global Daily Insight: Bitcoin (BTCUSD) – M1440 Trend Analysis

- August 31, 2025

- Posted by: DrGlenBrown2

- Category: Global Daily Insights

Bitcoin holds its macro bullish backbone on M1440 (Daily), with DAATS intact but weakening momentum. Read our Global Daily Insight for key zones, ATR analysis, and trading plan.

-

Exposure & Death-Stop – Sub-Linear Scaling with √P

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Risk Control, Quantum-Inspired Trading Systems

Trading is like navigating a quantum path where past moves shape future risks. Dr. Glen Brown’s Law 4 of the Nine-Laws Framework introduces sub-linear √P scaling and death-stops to manage exposure, inspired by path-dependent memory. This article explores how GATS1 to GATS43200 apply this law, adjusting stops and exits across timeframes from minutes to months, ensuring disciplined risk management in volatile markets.

-

Weighted Decay of DAATS – Smoothing Noise with Lindblad Dynamics

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Volatility Management, Quantum-Inspired Trading Systems

Market noise, like the random fluctuations of quantum particles, can disrupt trading precision. Dr. Glen Brown’s Law 2 of the Nine-Laws Framework refines the Dynamic Adaptive ATR Trailing Stop (DAATS) with a weighted decay mechanism, inspired by quantum decoherence, to smooth volatility. This article explores how GATS1 to GATS43200 apply this law, adjusting DAATS across timeframes from minutes to months, ensuring stability and adaptability in the face of market chaos.

-

Correlation Regime Transition – Detecting Systemic Stress with Entanglement

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Risk Management, Quantum-Inspired Trading Systems

Markets, like entangled quantum particles, can suddenly synchronize during systemic stress, amplifying volatility across assets. Dr. Glen Brown’s Law 1 of the Nine-Laws Framework, paired with the Global Algorithmic Trading Software (GATS), detects these correlation regime transitions using DAATS spikes and multi-timeframe alignments. This article explores how GATS1 to GATS43200 identify and respond to such stress, leveraging quantum entanglement principles to pause trades and hedge risks, ensuring resilience from minute-to-month timeframes.

-

The Nine GATS Strategies: A Quantum-Inspired Trading Spectrum

- June 28, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering, Algorithmic Trading, Quantum-Inspired Trading Systems

Financial markets, like quantum systems, are probabilistic and dynamic, oscillating between bullish, bearish, and choppy states. Dr. Glen Brown’s Nine-Laws Framework, powered by the Global Algorithmic Trading Software (GATS), harnesses this complexity through nine strategies, from the rapid Global Momentum Scalper (GATS1) to the enduring Global Monthly Trend Rider (GATS9). This article introduces these strategies, spanning timeframes from 1-minute to monthly, and their quantum-inspired design, rooted in the √Time Principle (√256 ≈ 16 exposures). By blending financial engineering with concepts like entanglement and path-dependent memory, GATS strategies offer a rigorous approach to trend-following and risk management, setting the stage for a series exploring the Nine Laws.

-

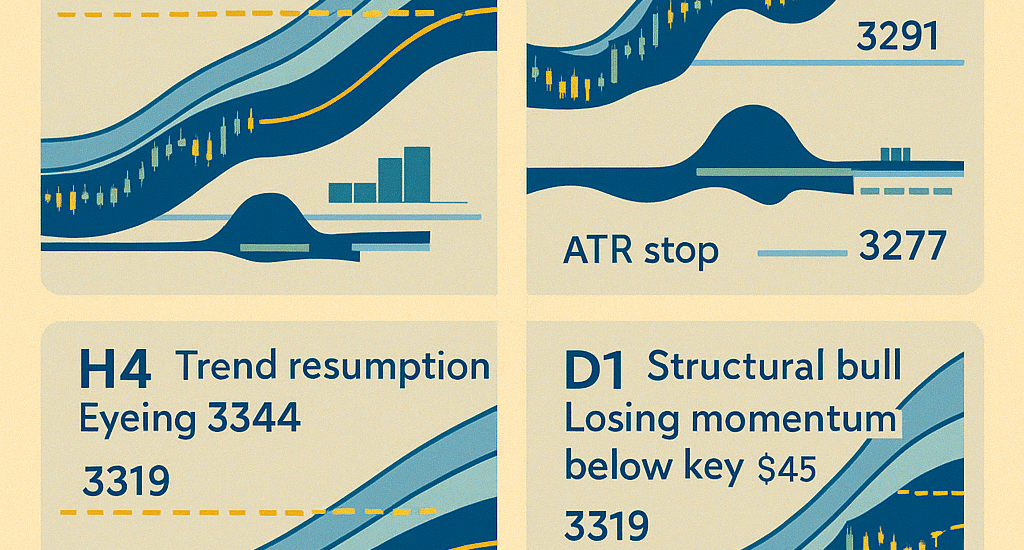

Gold (XAU/USD) Multi-Timeframe End-of-Day Analysis & GPTP

- May 22, 2025

- Posted by: DrGlenBrown2

- Category: Market Analysis

Discover the end-of-day multi-timeframe analysis for Gold across M30, H1, H4, and D1 using GATS WaveSafe ATR & EMA-Zone frameworks with actionable GPTP.

-

Platinum Daily “High-Conviction Bullish Blueprint”

- May 20, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

Discover the Platinum Daily “High-Conviction Bullish Blueprint” using the GATS framework—EMA zones, MACD, oscillators & tactical trade plan.