-

The Adaptive Quantum Doctrine of Breakevens & DAATS in GATS

- November 22, 2025

- Posted by: DrGlenBrown2

- Categories: Financial Engineering & Algorithmic Trading, Quantitative Risk Management

No Comments

Discover how GATS integrates Fractional Breakevens, Post-BE Dissipation, and DAATS into a quantum-adaptive risk system that minimizes drawdown and maximizes trend survival.

-

The Foundations of GATS: From EMA Zones to Quantum Risk Dynamics

- October 31, 2025

- Posted by: DrGlenBrown2

- Categories: GATS Lecture Series — Algorithmic Risk and Volatility Engineering, Global Algorithmic Trading Software (GATS)

Discover the foundational principles of GATS — Dr. Glen Brown’s advanced algorithmic trading framework that fuses EMA Zones, ATR-based risk logic, and quantum-inspired volatility management.

-

Two-Stage Trend-Following with GATS Strategy 5: From Macro Filters to Hourly Execution

- July 6, 2025

- Posted by: DrGlenBrown2

- Category: Trading Strategies

A comprehensive guide to combining multi-timeframe EMA filters with GATS Strategy 5 on the 1-hour chart, including ATR-based stops and profit targets.

-

Dr. Glen Brown’s Nine-Laws Framework Adaptive Volatility & Risk Management for Global Markets

- June 16, 2025

- Posted by: DrGlenBrown2

- Categories: Algorithmic Trading, ATR Trailing Stops, Model Validation “Law Rebirth”, Portfolio Construction, Risk Management, Volatility Modeling

Explore Dr. Glen Brown’s Nine-Laws Framework for Adaptive Volatility and Risk Management: an in-depth guide to regime detection, adaptive stops, break-even logic, portfolio noise budgeting & continuous model rebirth.”

-

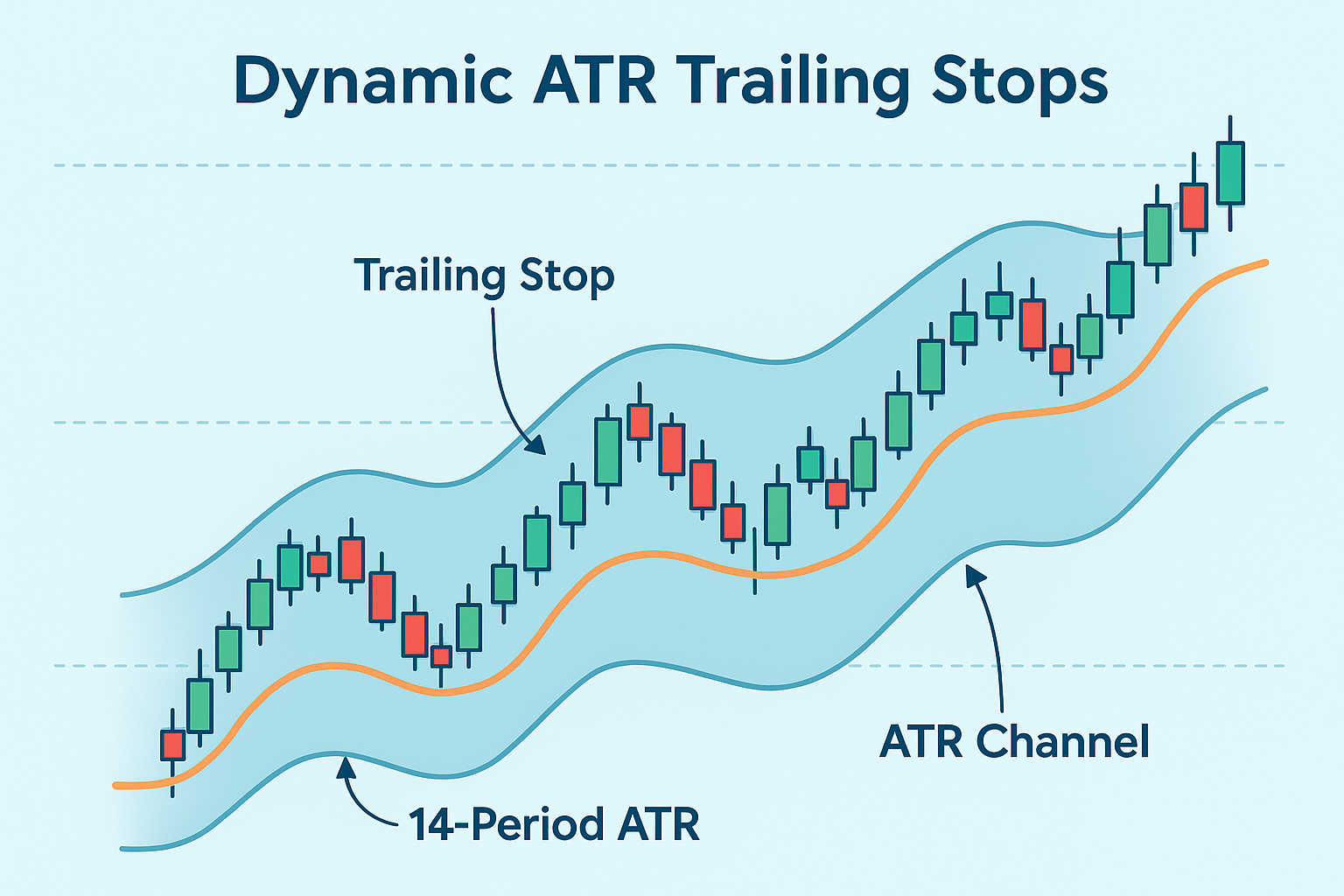

Dynamic Adaptive ATR Trailing Stops (DAATS): Volatility-Scaled Exits

- May 6, 2025

- Posted by: DrGlenBrown2

- Category: Risk Management / Algorithmic Trading

Learn how to deploy Dynamic Adaptive ATR Trailing Stops (DAATS) using ATR(89), square-root multipliers, and EMA zones to optimize trade exits.

-

Adaptive Risk Management Unleashed: The Dynamic ATR Trailing Stop (DAATS) Advantage

- March 10, 2025

- Posted by: DrGlenBrown2

- Category: Financial Engineering

Learn how the Dynamic ATR Trailing Stop (DAATS) offers a groundbreaking, adaptive approach to risk management, seamlessly integrating volatility and time scaling for enhanced trading outcomes.

-

Global Rapid Trend Catcher Insight Series #5: Refining Risk Management in Algorithmic Trading

- May 12, 2024

- Posted by: DrGlenBrown2

- Category: Algorithmic Trading Insights

Dive into the updated Global Rapid Trend Catcher Strategy with enhanced risk management and dynamic ATR trailing stops for improved trading results.