Shadow Width, Compression, and Structural Stress

- January 5, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Forward Transition Shadow Series — Part 4

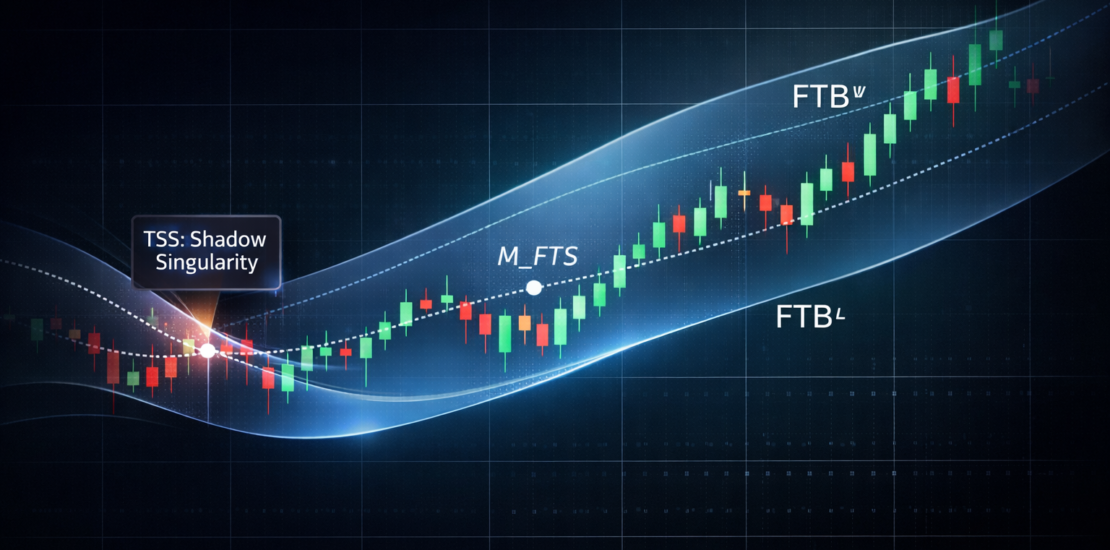

This article expands on the Forward Transition Boundary (FTBᵁ / FTBᴸ) and Forward Transition Shadow (FTS) doctrine within the GATS Framework. The full and authoritative doctrine is published here: Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

1. Why Width Matters More Than Location

Most traders focus on where price is relative to structure. Far fewer consider how wide that structure is.

The Forward Transition Shadow introduces a measurable quantity: shadow width. This width is not cosmetic. It is a direct expression of structural agreement—or the lack thereof.

A wide shadow implies structural confidence. A narrow shadow implies structural tension.

2. Defining Shadow Width

Shadow width is defined as the distance between the two forward-staged boundaries:

WFTS(t) = FTBᵁ(t) − FTBᴸ(t)

Because markets operate across instruments and volatility regimes, raw width alone is insufficient. Width must be interpreted relative to volatility.

For this reason, the doctrine evaluates width in normalized form:

W*FTS(t) = |WFTS(t)| / ATR50(t)

This normalization ensures that compression and expansion have consistent meaning across asset classes and timeframes.

3. Structural Expansion: What a Wide Shadow Indicates

When the Forward Transition Shadow is wide relative to volatility, the Transition Zone’s remembered structure is internally consistent.

This condition reflects:

- Stable directional agreement

- Low internal conflict between EMA 16 and EMA 25 memory

- Reduced likelihood of abrupt regime change

In practical terms, wide shadows support:

- Trend-following participation

- Patience in trade management

- Allowing volatility-based stops to function without interference

4. Structural Compression: The Build-Up of Stress

As the Forward Transition Shadow narrows, the distance between remembered structural boundaries collapses.

This compression signals:

- Diminishing structural agreement

- Increasing internal tension within the Transition Zone

- Rising probability of regime resolution

Importantly, compression does not specify direction. It specifies instability.

Many traders misinterpret compression as “low volatility” and increase activity. The GATS interpretation is the opposite:

Compression is not an invitation. It is a warning.

5. Compression Precedes Regime Events

Structural compression within the Forward Transition Shadow often precedes key regime events, including:

- Trend acceleration

- False breakouts and failed continuations

- The Transition Shadow Singularity (TSS)

By the time classic EMA crosses or momentum signals trigger, compression has often already resolved.

The shadow width therefore acts as an early stress gauge, revealing fragility before price action becomes obvious.

6. Compression vs Volatility: A Critical Distinction

Structural compression should not be confused with volatility contraction.

Volatility measures how far price moves. Shadow width measures how coherently structure is organized.

It is entirely possible for volatility to remain elevated while structural width collapses—an environment particularly hostile to discretionary decision-making.

This distinction is why the Forward Transition Shadow complements rather than duplicates ATR-based tools.

7. Operational Implications for GATS Users

As shadow width compresses:

- New entries should be reduced or paused

- Risk posture should shift from expansion to defense

- Patience becomes more valuable than activity

Conversely, expansion in shadow width following compression often confirms that a new structural regime has emerged.

8. Relationship to the Master Doctrine

This article explains how to interpret shadow width as a measure of compression and structural stress. It does not modify any formal rules, thresholds, or parameters.

All definitive specifications remain exclusively defined in the master doctrine:

Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

Next in the series:

Forward Transition Shadow Series — Part 5: Transition Shadow Singularity (TSS) and Regime Stand-Down

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., proprietary trading firms specializing in institutional trading systems, volatility-aware risk management, and multi-timeframe market structure design through the GATS Framework.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as proprietary trading firms. All concepts discussed are provided for educational and informational purposes only and do not constitute investment advice or an offer to manage external capital.

General Disclaimer

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Trading decisions are the sole responsibility of the reader. Examples are illustrative and not indicative of future performance.

Risk Disclaimer

Trading financial markets involves substantial risk and may result in the loss of some or all invested capital. Past performance is not indicative of future results. Always assess your risk tolerance and seek independent professional advice where appropriate.