How FTS Changes Risk Posture, Not Just Entries

- January 9, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Forward Transition Shadow Series — Part 7

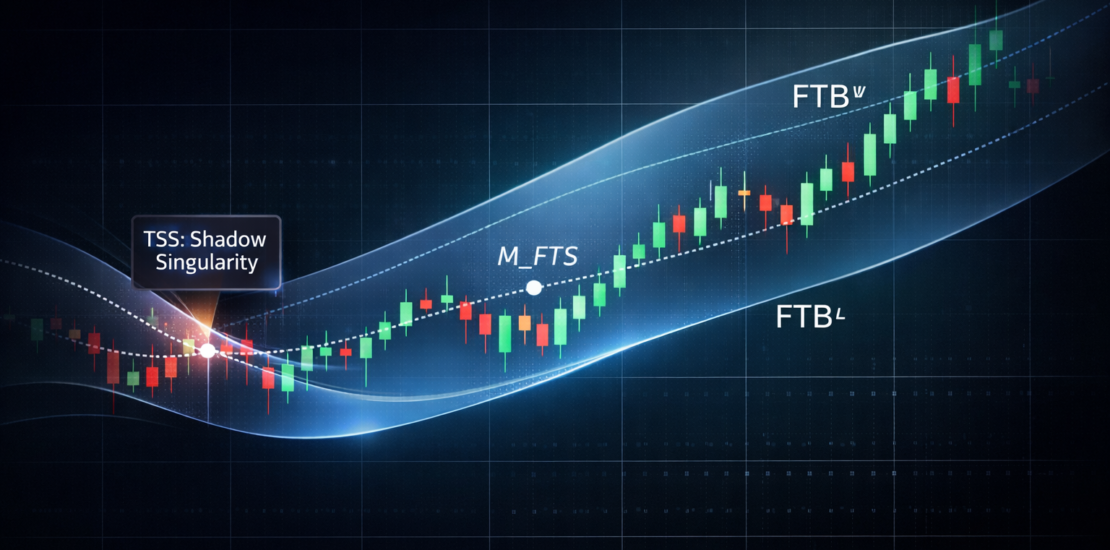

This article expands on the Forward Transition Boundary (FTBᵁ / FTBᴸ) and Forward Transition Shadow (FTS) doctrine within the GATS Framework. The complete and authoritative doctrine is published here: Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

1. The Common Misuse of Structure

Many trading frameworks treat structure as a trigger mechanism. Lines are crossed, signals fire, and trades are taken.

Within GATS, structure serves a different and higher purpose: it defines risk posture.

The Forward Transition Shadow exists not to increase activity, but to regulate exposure.

2. Risk Posture vs Entry Timing

Entry timing answers the question:

“Is this a technically valid setup?”

Risk posture answers a more important question:

“Is this an environment where capital should be deployed at all?”

The Forward Transition Shadow informs the second question. It determines whether valid setups are acted upon, reduced, delayed, or ignored.

3. The Three FTS Risk Postures

3.1 Commitment Participation

When price is decisively outside the Forward Transition Shadow in the direction of the prevailing regime, structure is coherent.

This posture supports:

- Normal position sizing

- Trend-following participation

- Allowing volatility-based stops to operate fully

3.2 Controlled Exposure

When price operates inside the Forward Transition Shadow, structure is negotiating.

In this posture:

- Position sizes should be reduced

- Confirmation requirements should be higher

- Trade frequency should decline

Controlled exposure acknowledges opportunity without ignoring structural uncertainty.

3.3 Structural Stand-Down

When the Forward Transition Shadow collapses or inverts (Transition Shadow Singularity), the correct posture is non-participation.

Stand-down is an active decision, not a failure to act.

4. Why Risk Must Change Before Entries Do

Structural stress appears before price reversal. Compression appears before expansion. Singularity appears before resolution.

By the time classic entry logic fails, capital has already been exposed.

The Forward Transition Shadow shifts risk management left in time.

Exposure is reduced when uncertainty rises, not after losses occur.

5. Interaction With Volatility-Based Risk Management

The Forward Transition Shadow does not replace volatility-based risk tools such as ATR or DAATS.

Instead, it determines whether those tools should be allowed to operate fully.

In compressed or singularity environments, even well-calibrated volatility stops may be insufficient.

FTS therefore acts as a risk permission layer above execution and stop logic.

6. Behavioral Discipline Enforced by FTS

Many drawdowns are behavioral rather than technical.

Traders increase activity during uncertainty, misinterpreting compression as opportunity.

The Forward Transition Shadow counters this impulse by formalizing when restraint is required.

Capital preservation is not passive. It is a structural decision.

7. Relationship to the Master Doctrine

This article explains how the Forward Transition Shadow informs risk posture and capital deployment decisions.

All formal definitions, thresholds, and enforcement rules remain exclusively defined in the master doctrine:

Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

Next in the series:

Forward Transition Shadow Series — Part 8: Common Misinterpretations and Misuse of FTS

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., proprietary trading firms specializing in institutional trading systems, volatility-aware risk management, and multi-timeframe market structure design through the GATS Framework.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as proprietary trading firms. All concepts discussed are provided for educational and informational purposes only and do not constitute investment advice or an offer to manage external capital.

General Disclaimer

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Trading decisions are the sole responsibility of the reader. Examples are illustrative and not indicative of future performance.

Risk Disclaimer

Trading financial markets involves substantial risk and may result in the loss of some or all invested capital. Past performance is not indicative of future results. Always assess your risk tolerance and seek independent professional advice where appropriate.