Forward Transition Shadow Across Timeframes

- January 6, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Forward Transition Shadow Series — Part 6

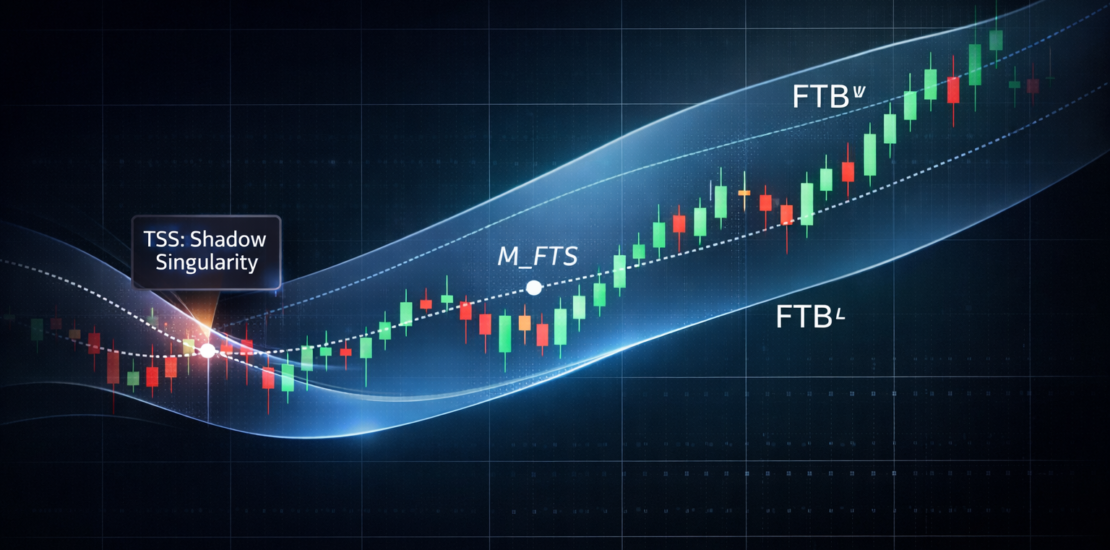

This article expands on the Forward Transition Boundary (FTBᵁ / FTBᴸ) and Forward Transition Shadow (FTS) doctrine within the GATS Framework. The full and authoritative doctrine is published here: Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

1. Why Timeframe Context Is Non-Negotiable

Market structure does not exist in isolation. Every timeframe expresses its own regime, volatility profile, and structural memory.

The Forward Transition Shadow does not override this hierarchy. Instead, it makes the hierarchy explicit by revealing where structure is stable, stressed, or unresolved on each timeframe independently.

A Forward Transition Shadow must therefore always be interpreted within its timeframe context.

2. The Principle of Regime Hierarchy

Within the GATS Framework, higher timeframes define regime commitment, while lower timeframes define execution opportunity.

The Forward Transition Shadow reinforces this principle:

- Higher-timeframe FTS governs directional legitimacy

- Lower-timeframe FTS governs tactical participation

No lower-timeframe signal can invalidate a higher-timeframe structural regime.

3. Daily Forward Transition Shadow

On the Daily timeframe, the Forward Transition Shadow functions as a primary regime filter.

Daily FTS answers the most important question:

Is the market structurally trending, negotiating, or resetting?

Daily-level Transition Shadow Singularity (TSS) events are rare and highly consequential. When they occur, they often precede major regime changes.

As a result, Daily FTS should be treated as authoritative for bias and participation posture across all lower timeframes.

4. Intraday Forward Transition Shadow

On intraday timeframes (e.g., M15, M30, M60), the Forward Transition Shadow serves a different role.

Rather than defining the macro regime, intraday FTS governs:

- Entry timing

- Pullback quality

- Short-term stand-down periods

A Transition Shadow Singularity on an intraday chart typically signals tactical ambiguity rather than macro reversal. In such cases, discipline—not anticipation—is required.

5. Higher-Timeframe vs Lower-Timeframe TSS

Not all TSS events carry the same weight. Their significance is determined by timeframe alignment.

- Higher-timeframe TSS: Indicates a genuine structural reset and demands broad stand-down.

- Lower-timeframe TSS: Indicates local compression or digestion within an intact higher-timeframe regime.

Confusing the two is a common source of premature exits and missed opportunities.

6. Cross-Timeframe Alignment Rules

The GATS interpretation of multi-timeframe FTS can be summarized as follows:

- Trade only in the direction permitted by the higher-timeframe FTS.

- Use lower-timeframe FTS to refine timing and manage risk.

- Respect lower-timeframe TSS as a pause, not a reversal, unless confirmed by higher timeframes.

- Never override higher-timeframe structural invalidation with lower-timeframe signals.

This hierarchy preserves coherence and prevents structural conflict.

7. Why This Matters for Capital Preservation

Many trading losses occur not because of poor analysis, but because of timeframe confusion.

The Forward Transition Shadow clarifies where structure is breaking and where it remains intact.

By enforcing regime hierarchy, FTS prevents traders from mistaking tactical noise for strategic change.

8. Relationship to the Master Doctrine

This article explains how the Forward Transition Shadow should be interpreted across multiple timeframes.

All formal definitions, thresholds, and enforcement rules remain exclusively defined in the master doctrine:

Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

Next in the series:

Forward Transition Shadow Series — Part 7: How FTS Changes Risk Posture, Not Just Entries

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., proprietary trading firms specializing in institutional trading systems, volatility-aware risk management, and multi-timeframe market structure design through the GATS Framework.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as proprietary trading firms. All concepts discussed are provided for educational and informational purposes only and do not constitute investment advice or an offer to manage external capital.

General Disclaimer

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Trading decisions are the sole responsibility of the reader. Examples are illustrative and not indicative of future performance.

Risk Disclaimer

Trading financial markets involves substantial risk and may result in the loss of some or all invested capital. Past performance is not indicative of future results. Always assess your risk tolerance and seek independent professional advice where appropriate.