Common Misinterpretations and Misuse of the Forward Transition Shadow

- January 9, 2026

- Posted by: DrGlenBrown2

- Category: Quantitative Trading Systems

Forward Transition Shadow Series — Part 8 (Final)

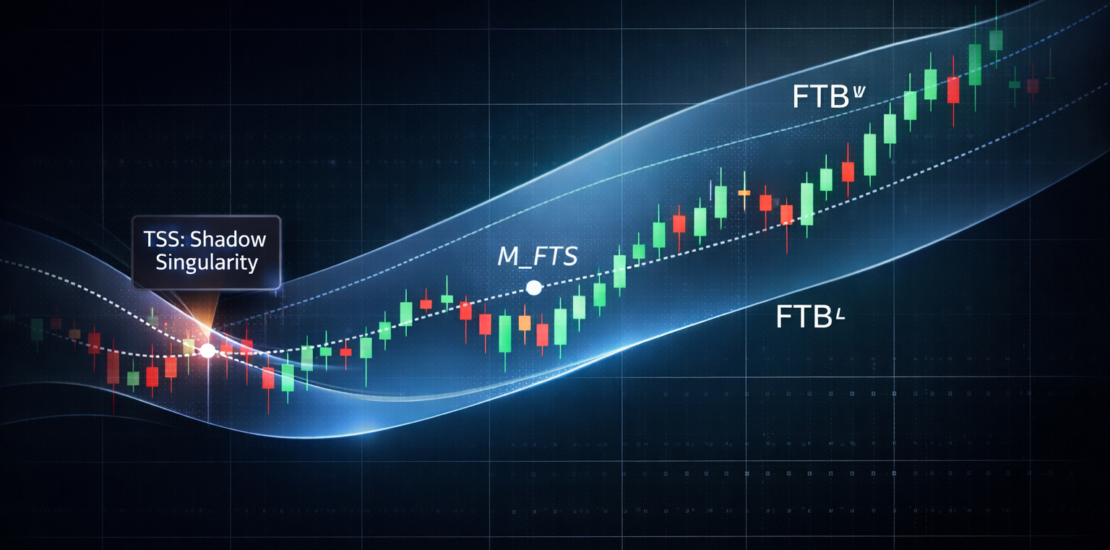

This article concludes the Forward Transition Shadow Series. It expands on the Forward Transition Boundary (FTBᵁ / FTBᴸ) and Forward Transition Shadow (FTS) doctrine within the GATS Framework. The full and authoritative doctrine is published here: Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS) .

1. Why This Clarification Is Necessary

Any structural framework that adds depth inevitably invites misuse when interpreted through a signal-driven mindset.

The Forward Transition Shadow is particularly vulnerable to misinterpretation because it looks deceptively similar to familiar technical constructs while serving a fundamentally different purpose.

This final article exists to clearly state what the Forward Transition Shadow is not, thereby preserving its institutional integrity.

2. Misinterpretation #1: “FTS Is a Trading Channel”

The Forward Transition Shadow is not a channel in the classical sense.

Channels are designed to identify repetitive price reactions. The FTS is designed to evaluate structural legitimacy.

Price is not expected to bounce predictably from FTBᵁ or FTBᴸ. Instead, the question is whether price is operating with or against remembered structure.

3. Misinterpretation #2: “FTS Crossings Are Entry Signals”

Treating the crossing of the Forward Transition Boundaries as a buy or sell signal is a critical error.

The Transition Shadow Singularity (TSS) indicates:

- Structural collapse

- Loss of regime continuity

- Maximum uncertainty

This is precisely the environment where signal-based trading performs worst. The correct response to TSS is stand-down, not anticipation.

4. Misinterpretation #3: “FTS Predicts the Future”

Forward-staged structure is often confused with prediction. This is incorrect.

The Forward Transition Shadow does not forecast price direction. It reflects where structure was recently organized, staged into the present for comparison.

FTS provides context, not prophecy.

5. Misinterpretation #4: “FTS Repaints”

Another common concern is that forward-staged lines repaint. They do not.

Each FTB value is derived from completed historical EMA data. Once calculated, those values remain fixed.

Any movement in the shadow occurs because new bars are added, not because past values are altered.

6. Misinterpretation #5: “FTS Replaces Other GATS Tools”

The Forward Transition Shadow does not replace:

- EMA Zones

- Volatility tools (ATR, DAATS)

- Momentum confirmation

- Multi-timeframe regime commitment

It operates above them as a structural permission layer.

FTS determines when those tools should be trusted, not how they are calculated.

7. Correct Mental Model for FTS

The Forward Transition Shadow should be understood as:

- A structural memory corridor

- A regime coherence filter

- A capital-preservation governor

Its purpose is to reduce exposure during uncertainty and enable confidence during structural clarity.

FTS does not tell you what to trade. It tells you when trading is justified.

8. The Series in Context

With this article, the Forward Transition Shadow Series is complete.

The series has progressively addressed:

- Why the Transition Zone required a shadow

- How forward-staged structure works

- Negotiation, compression, and singularity

- Multi-timeframe hierarchy

- Risk posture governance

- Common misuse and misinterpretation

All formal definitions and enforceable rules remain exclusively defined in the master doctrine.

Master Doctrine:

Forward Transition Boundary (FTB) & Forward Transition Shadow (FTS)

This series is now sealed.

About the Author

Dr. Glen Brown is President & CEO of Global Accountancy Institute, Inc. and Global Financial Engineering, Inc., proprietary trading firms focused on institutional trading systems, structural risk management, and multi-timeframe market intelligence through the GATS Framework.

Business Model Clarification

Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. operate exclusively as proprietary trading firms. All material is provided for educational and informational purposes only and does not constitute investment advice or an offer to manage external capital.

General Disclaimer

This content is for educational purposes only and does not constitute financial, legal, or investment advice. Trading decisions are the sole responsibility of the reader. Examples are illustrative and not indicative of future performance.

Risk Disclaimer

Trading financial markets involves substantial risk and may result in the loss of some or all invested capital. Past performance is not indicative of future results. Always assess your risk tolerance and seek independent professional advice where appropriate.