-

The Global 365 Thought Leadership Series — Index

Read moreExplore the Global 365 Thought Leadership Series by Dr. Glen Brown—an unprecedented collection of 365 lectures covering structural intelligence, market doctrine, volatility engineering, multi-timeframe identity, Guidex Theory, tokenized assets, valuation models, portfolio architecture, and the Phoenix Doctrine. A full year of high-level financial engineering and institutional-grade trading philosophy.

-

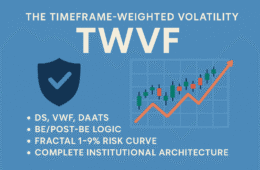

The Dr. Glen Brown Timeframe-Weighted Volatility Framework (TWVF): A Unified Institutional Doctrine for Multi-Timeframe Trading

Read moreThe Timeframe-Weighted Volatility Framework (TWVF) is Dr. Glen Brown’s signature institutional doctrine, unifying volatility truth, trend structure, risk identity, and multi-timeframe execution across all nine GATS strategies. This white paper introduces the full model, including DS, VWF, DAATS, BE/Post-BE logic, the fractal 1–9% risk curve, and the complete institutional architecture behind TWVF.

-

Global Multi-Asset ETF Portfolio White Paper v1.0 – GAI & GFE

Read moreThis white paper presents the Global Multi-Asset 50-ETF Portfolio engineered for Global Accountancy Institute, Inc. and Global Financial Engineering, Inc. It unifies GATS, the Universal Risk Doctrine (DS = 16 × ATR256), the 1–9% timeframe-indexed risk model, and the Nine-Laws Framework into a single proprietary trading doctrine for cross-asset, multi-timeframe execution.

-

Global Multi-Asset ETF Master Portfolio for GFE & GAI

Read moreDiscover the Global Multi-Asset ETF Master Portfolio designed by Dr. Glen Brown for GFE & GAI, integrating GATS, DAATS, and the Nine-Laws Framework into a unified, institution-grade ETF universe.

-

Guidex Theory – Reframing Digital Currencies as a Global Kinetic Energy Matrix

Read moreGuidex Theory – White Paper v1.0, authored by Dr. Glen Brown, reframes digital currencies as nodes in a global kinetic energy matrix. The paper introduces the Kinetic Index Score (KIS), a four-dimensional Guidex Matrix, entropy regimes, and a complete integration with GATS, DAATS, and the Nine-Laws Framework to build structurally robust, energy-aware crypto portfolios.

-

Guidex Theory: Reframing Digital Currencies as a Global Kinetic Energy Matrix

Read moreGuidex Theory redefines Bitcoin and digital assets as nodes in a global kinetic energy matrix—transforming computational work and electrical power into digital reserves. Dr. Glen Brown introduces a new valuation and trading framework grounded in thermodynamics, entropy, and adaptive market regimes.

-

The Adaptive Quantum Doctrine of Breakevens & DAATS in GATS

Read moreDiscover how GATS integrates Fractional Breakevens, Post-BE Dissipation, and DAATS into a quantum-adaptive risk system that minimizes drawdown and maximizes trend survival.

-

Global Lottery Structural Analysis Model (GLSAM) v1.1

Read moreThe Global Lottery Structural Analysis Model (GLSAM) v1.1 is the world’s first fully formalized, non-predictive structural entropy framework for high-randomness lottery systems such as Powerball. In this white paper, Dr. Glen Brown introduces GLSAM’s regime architecture, entropy envelopes, Powerball Entropy Index (P-Index), AntiCrowd logic, and the Research Note Series/Long-Term Structural Matrix ecosystem under the Global Entropy & Game Theory Research Division.

-

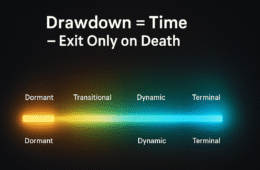

Lecture 7: The Law of Drawdown in Time — Quantum Implications for Trade Longevity

Read moreThis lecture formalizes the GATS axiom that drawdown should cost time, not capital. We map equity drawdown to a temporal budget via ATR-regime geometry and codify how DS (Death-Stop), DAATS (Dynamic Adaptive ATR Trailing Stop), and the 18.75% Law synchronize to convert equity risk into structured time expenditure. We then extend this to portfolio heat, shock handling, and “Exit Only on Death” discipline, with quantitative tables and MT5/GATS implementation blocks.

-

Lecture 6: The Geometry of Time — Trade Lifecycles, Resonant Durations, and Temporal Compression within GATS

Read moreThis lecture develops the Temporal Geometry Model within the Global Algorithmic Trading Software (GATS). Each trade is treated as a temporal organism whose lifespan expands or contracts with volatility, multi-timeframe alignment, and the 18.75% adaptive law. We formalize Temporal Compression (TC), Resonant Duration (Tres), and Chrono-Risk Scaling, and provide MT5/GATS execution patterns that convert volatility into measurable time.

Reach out to Global Accountancy Institute, Inc. at our main campus or connect with us through our online portal. Whether you’re seeking information on our programs, need guidance on your financial education journey, or have inquiries about our proprietary trading initiatives, our dedicated team is here to assist you every step of the way.

“Explore how our innovative education model is shaping the future of finance. Our unique blend of theoretical knowledge and practical application prepares our students for the complexities of the global financial landscape.”